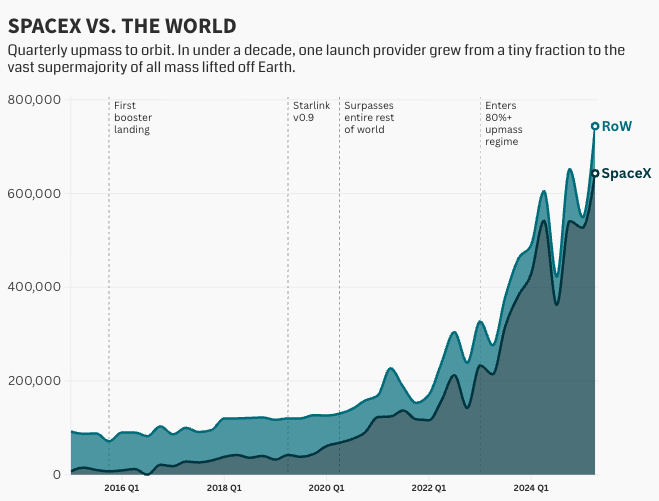

The story of upmass over the last five years has been simple: There is SpaceX, and then there is everyone else.

Upmass, for the uninitiated, is payload mass to orbit, e.g. the total weight of what we lift to space ex rockets. It’s one of the vital biomarkers of a healthy, robust space economy.

In the third quarter, SpaceX was responsible for 83% of all mass launched to orbit globally, and 97% of American upmass. Since capturing the lion’s share in 2020, SpaceX hasn’t looked back:

Three key trends to watch, all driven by reusable rocketry:

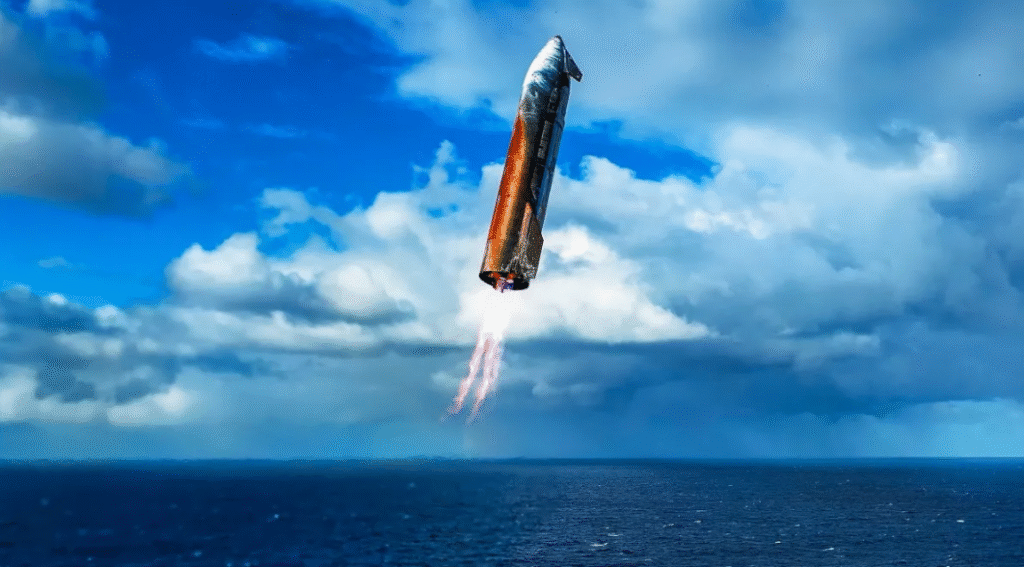

001 // The Starship program. Paradoxically, SpaceX’s biggest threat may very well be…SpaceX. If Starship hits its reliability, cadence, and reuse targets, it will displace Falcon and potentially run up SpaceX’s share into the 90-95%+ range.

002 // New Glenn’s ramp. With its NG-2 mission last month, Blue Origin became the second in history to land an orbital-class rocket when it recovered its booster on the Jacklyn droneship at sea. Blue has announced upgrades rolling into NG-3 (first-stage thrust 3.9M → 4.5M lbf, upper-stage thrust +25%, reusable fairing, enhanced TPS), plus a super-heavy variant: NG 9×4.

Starlink was a key catalyst for SpaceX, giving the company a captive customer that allowed it to ramp launch cadence and upmass on its own terms. New Glenn has its own captive customer in Amazon Leo, the artist formerly known as Project Kuiper, plus a dozen-plus missions targeted for next year and a packed manifest of external customers (including NASA and NSSL certification flights).

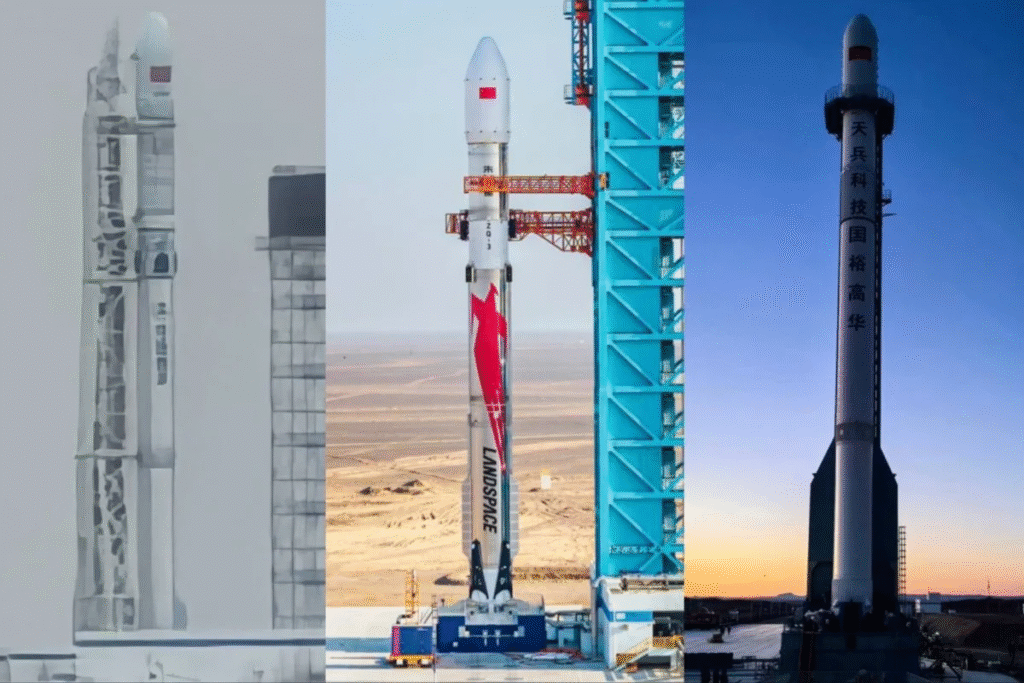

003 // Chinese launchers waiting in the wings: Three Chinese rockets, all designed for first-stage recovery, are currently lined up at the Jiuquan Satellite Launch Center in northwest China. Each was expected to debut before year-end, but that’s looking less likely now. LandSpace scrubbed the promising Zhuque-3’s maiden launch for unknown reasons, with apparently substantial delays. Space Pioneer’s Tianlong-3 is on the pad but, rather notably, lacks landing hardware. We’ve seen murmurs online that SAST, the state-owned contractor, is leveraging its influence with the Party to push for its rocket, the Long March 12A, “to go first.”

| Rocket | Developer | Payload (kg) |

| Zhuque-3 | LandSpace | 11,800 kg |

| Tianlong-3 | Space Pioneer | 17,000 kg |

| Long March 12A | SAST | 12,000 kg |

It’s likely that one of these developers will eventually succeed, and become the first non-American entity to propulsively land an orbital-class booster. This would mark the beginning of a two-front challenge to SpaceX’s dominance: Blue from the West, and a rapidly maturing Chinese launch sector from the East.

Per Aspera’s Takeaway: The U.S. faces a manufacturing and hardware development deficit across many strategic technology domains. Fortunately, this does not include rockets (see chart above) and satellites (~70% of active birds are American), thanks in massive part to a singular firm: SpaceX. But competition is a good thing, and with a pacing challenger in the East, now is not the time to take our foot off the gas. The world is already accelerating: in November, humanity flew 31 orbital missions, marking the first time in history we launched more rockets than there were days in the month.