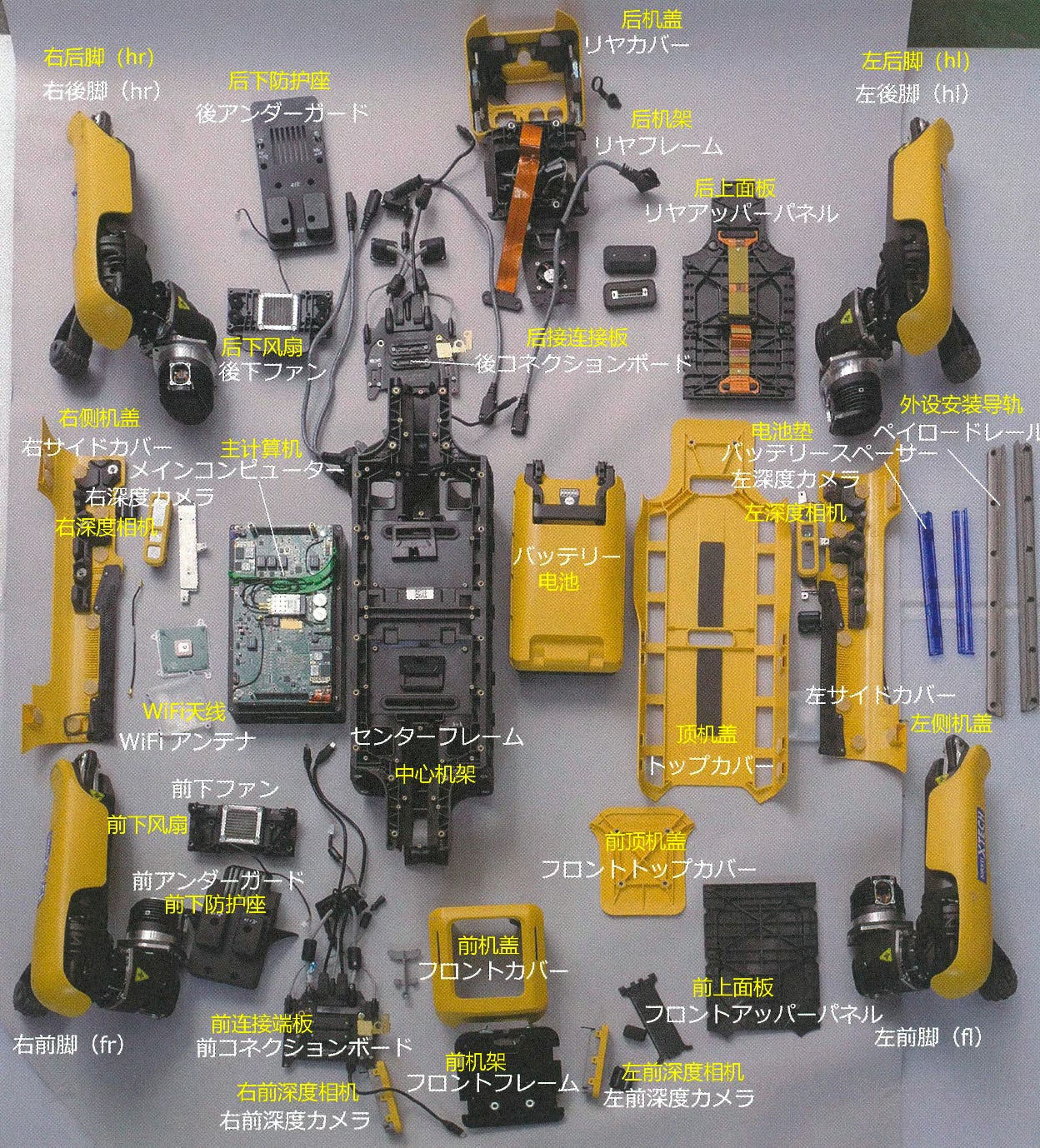

Spot Robo-Dog

A 200-page teardown of Boston Dynamics’ Spot robo-dog has been making the rounds online recently. Written entirely in Chinese, the document is forensic in its detail. The report’s authors put Spot through its paces, stripping the quadruped down to its motors, mapping payload interfaces, and even accidentally dunking it in a flooded drainage channel.

Spot’s engineering brilliance is undeniable, the engineers note. The robot’s leg actuation achieves a level of fluid locomotion that looks straight out of the animal kingdom, the kind that has made Boston Dynamics world-famous. But the teardown also exposes the robot’s limits: dustproof-not-waterproof sealing, avionics-grade components ill-suited for industrial disassembly, and a tendency to slip on wet surfaces. (Though, to be fair to Spot, who among us doesn’t have this tendency? 🙋)

Call it competitive intelligence or industrial espionage with receipts…either way, it’s old news. The teardown is from 2021. The robotics ecosystem has moved on. Which brings us to today’s main story: How a cottage industry of lab-bound curiosities has transformed into a capitalized, battle-tested production juggernaut…in China, at least.

Two Humanoid IPOs, In This Economy?!?

It seems as if not one but two of China’s leading humanoid robot makers will IPO on the Shanghai STAR stock exchange within the next year, in a sign of how fast the sector has matured arrived.

- Leju Robotics has raised $210M+ in pre-IPO funding, with preparations for a public listing well underway. The Shenzhen-based humanoid maker is partnered with 40+ companies, including giants like Tencent, Huawei, Alibaba, and China Mobile, to deploy its Kuavo bot in factories.

- And, earlier this year, Unitree Robotics filed for a $7B IPO, recording $140M+ in 2024 revenue and four years of positive cash flow (a rarity in robotics).

Unitree, Unpacked

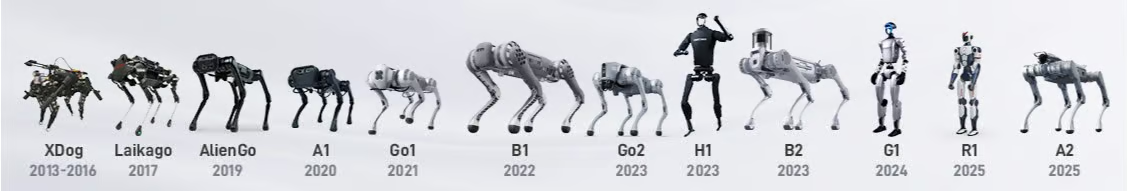

The firm aims to be to ground robotics what DJI is to the skies — to dominate the market (both humanoid and quadruped) with accessible, mass-producible, and aggressively priced hardware. And so far, so good. DJI sells 70-75% of all drones globally. Unitree, meanwhile, commands a ~70% share of the quadruped market.

And Unitree is no one-trick-(robo)pony. Its product family spans multiple form factors:

- Go2, Go2-W: quadrupeds with LiDAR and GPT-enabled control for developers and hobbyists.

- B2, B2-W: industrial wheeled–leg robots capable of carrying 40–120 kg payloads across rough terrain at 20 km/h.

- G1: mid-size bipedal robot (127 cm tall) with 23–43 joint motors, capable of running, squatting, and backflipping.

- H1: full-scale bipedal robot (180 cm tall) with 19–27 joint motors.

- H2, unveiled earlier this month: a 70 kg humanoid with enhanced limb articulation, 7 DoF arms, and modular Nvidia Jetson compute units.

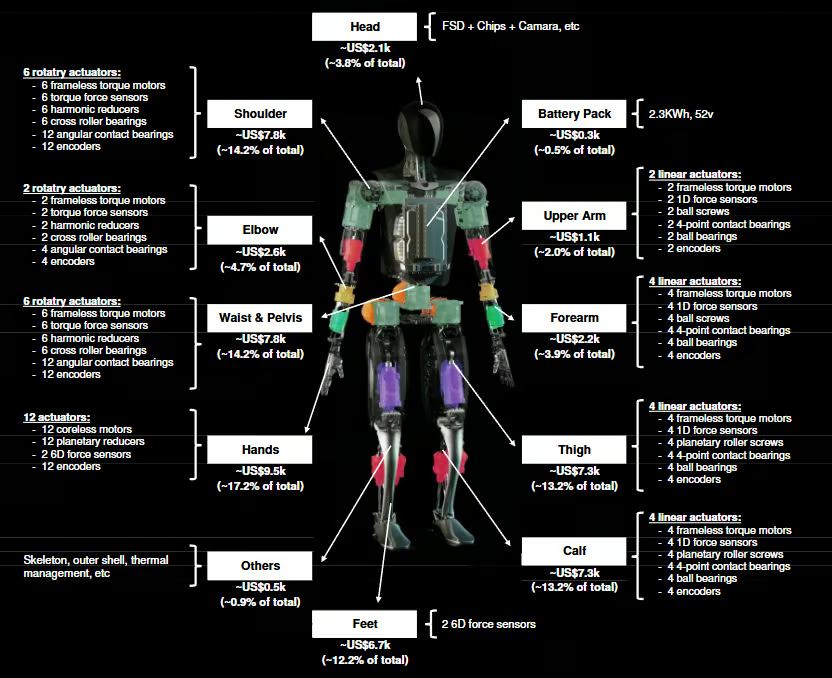

Anatomy of an Automototon

The story behind the story is unit economics and the BoM (bill of materials). We look at the trendlines for both Western and Chinese ecosystems. Below, you’ll see an estimated BoM for Optimus, a robot from the most vertically integrated Western robotics developer: Tesla.

Morgan Stanley researchers peg Western humanoid costs, today, at $50,000-$60,000 a unit. This is trending in the right direction, down from $200,000+ just a few years ago, but Western robots are exquisitely priced relative to Asian counterparts. Case in point: AUnitree humanoid now retails for as low as $5,900, which we fixated on almost ad nauseam in The Last Hardware Problem. That’s aggressively low, likely at or below cost. But it’s still remarkable.

What Drives the Cost Gap?

Three structural advantages for China:

- Deployment density: China out-deployed the U.S. with industrial robots nearly 9-to-1 last year. (A similar story persists across all form factors, whether they’re wheeled or quadrupeds).

- Vertical integration: Chinese OEMs often build their own actuators, motors, and reducers in-house. If they don’t, they source from Shenzhen suppliers down the street.

- Cost arbitrage: Western supply chains depend on these same Chinese components.

- Actuators, for instance, consume 30-55% of total humanoid BoM.

- A humanoid built with Chinese components costs $46,000 versus $131,000 using non-Chinese supply chains.

- Actuators alone: $22,000 versus $58,000.

China controls ~63% of the humanoid supply chain and dominates rare-earth processing (90%+), battery manufacturing (70%+), leaving Western roboticists dependent on Chinese components, with few, if any, viable alternatives.

State of Play, Game Theory, & So What?

Humanoids are inverting the smartphone/semiconductor model. Whereas the latter is design in the West, develop in the East, diffuse everywhere, humanoids are design, deploy, diffuse in the East, with the West mostly just designing.

The bet is straightforward: that the BYD/DJI playbook will also work for quadrupeds and bipedal humanoids. It worked for batteries. Worked for drones. Why not robots? Well, maybe because humanoids are harder. Maybe the “general-purpose robot” is like self-driving: the last 20% of real-world reliability and long-tail edge cases eats 80% of your development time.

Still, you don’t have to buy into the humanoid hype to take this seriously. Why? Because the infrastructure one needs to build for humanoids — actuators, sensors, advanced manufacturing capacity, embodied AI training loops, supply chain muscle, etc — can just as readily be used in a dozen other critical technology areas. So, China has two paths to victory.

- If humanoids “work” in the near term…China wins decisively, with 1M+ units shipped, insurmountable cost advantages, and unmatched real-world data that the West cannot easily replicate.

- If humanoids stall, the investment still “breaks even.” The toolchain doesn’t go to waste. Instead, it’s repurposed for logistics, drones, advanced manufacturing, and autonomy.

Per Aspera’s 2¢

So, there you have it. The West is betting on software, autonomy, and design excellence. China is betting on owning the end-to-end, full-stack industrial base. No matter how you game this out, there’s only one rational move for the U.S., and that’s to also make the full-stack bet. Don’t just design, build better. Own the supply chain. Control the manufacturing. That’s the only strategy where we don’t lose.