Introduction

Foreword

Venture capital was never supposed to be an easy affair. Its tinkering, trailblazing pioneers were a boisterous sort. They invested not in virtual abstractions, but the real world: semiconductors, computing hardware, early biotechnology, and medical devices.

These OGs accepted uncertainty not merely as the cost of doing business but as its superseding virtue. They staked fortunes on ventures requiring a delicate dance between physics, chemistry, market acceptance, and sheer human power of will.

Then, something changed.

The 2010s unleashed a software gold rush, which muzzled that early maverick spirit and professionalized VC almost overnight. What was once an eccentric cottage industry matured into a global financial asset class, attracting legions of LPs and institutional investors eager for a position in the new software-defined boom. This influx of capital birthed a new breed of firm, the megafund, with war chests scaling from billions to tens of billions, culminating in Masayoshi Son’s staggering $100B Vision Fund.

For every action there is an equal and opposite reaction. With the Silicon Valley set intoxicated on bits, the risk capital that once fueled factories, cleanrooms, and daring technical frontiers was seemingly vanishing into codebases and the cloud. VCs were chasing a new prize: ventures promising immediate scale, winner-take-all markets, and rapid markups.

But the gravy train ran out of propulsion. Markets saturated and growth slowed, with AI exposing many software businesses as having flimsy, indefensible moats.

Meanwhile, a wobbling world order starkly reminded us that history had not, in fact, ended. The twin shocks of a revanchist Russia rolling tanks into Ukraine and repeated pandemic-induced supply chain failures exposed the West’s industrial fragility. The sleepwalking escape into abstraction was over, replaced by a cold awakening: to surrender one’s industrial base is to surrender control over one’s own destiny.

Hardware is back on the menu.

Now, the cycle turns once again and a new consensus is emerging. The real world, of atoms and electrons, beckons once more. With American factories and cleanrooms roaring back to life, we’re in a Renaissance of Hard Pursuits.

Yet a new set of investors is underwriting this moment. The maverick specialists of the past have given way to a new breed of manager. Today’s megafunds have consolidated capital into fewer, larger, and more generalist hands, which prize scale over the specialization that defined venture’s earlier vintages.

America wants a technology-enabled industrial comeback, but structural forces have changed how we fund (or don’t fund) early-stage innovation. Below, this Antimemo will dig into these tensions:

- Is today’s venture capital stack fit for purpose?

- What are the risks of taking fewer, larger bets on the future?

- How do we reconcile the demand for rapid returns with patient timelines and the capital-hungry nature of hardware?

- Do our VCs have the specialized chops, technical capacity, and conviction required to underwrite America’s next technology-driven industrial chapter?

Section 001

Where are you going? Where have you been?

A Short History: The Software Supremacy Era

In the summer of 2011, Marc Andreessen’s manifesto, Software Is Eating the World, coined a memorable term, front-ran the zeitgeist, and captured the logic of an era.

Delivered with the bravado of someone who’d personally ushered in a new software paradigm with Netscape, Andreessen’s vision was intoxicatingly clear: every industry, every company, every sector was poised to be transformed by software. Code was like an infinitely replicable asset, unburdened by what has been the messy realities of atoms.

Silicon Valley had already forsaken its industrial past for a digital future. VCs eagerly poured resources into companies whose primary asset was intellectual: lines of code that could be scaled at near-zero marginal cost, effortlessly traversing borders and segments alike.

Venture changed to meet the moment. Funds grew to accommodate soaring valuations. TImelines compressed. Pattern-matching hardened into a playbook with a Moneyball-esque assortment of metrics-driven benchmarks: LTV:CAC ratios, ARR growth, etc…

This strategy produced trillion-dollar giants like Google and Facebook. As was written, these digital behemoths quickly became anchors of the new economy (and somewhat ironically, rent-seeking platforms that benefitted the most from the software gold rush.)

Edge of sword, meet other edge of the sword.

The paradox of software’s success would eventually become clear. The very traits that made it irresistible (speed, modularity, open tooling) made software easy to copy, as strengths (ease of deployment, near-zero marginal costs) crystallized into vulnerabilities.

Cloud computing, open-source libraries, and AI turned what was once proprietary into something cheap, abundant, and — VC trigger word warning — commoditized.

American, Chinese, and RoW copycats multiplied, making it nearly impossible to distinguish genuine innovation from a sea of competitors. Investors now find themselves in a crowded, overheated market where yesteryear’s decacorn-scale opportunity is today’s cautionary tale.

As the software gold rush wound down, the VC sector has gradually rediscovered and diversified back into the complexity, physicality, and technical depth of the real world.

Deep Tech’s Renaissance

The high priests of software maximalism got one thing backward: all virtual abstractions need bare metal and engineered matter to run on. Every bit needs an atom. Software demands hardware — chips, power, and infrastructure — to execute its code, and hardware breakthroughs unlock entirely new classes of applications.

A novel battery chemistry fuels EVs, which in turn create markets for fleet-management AI; advances in sensor materials enable self-driving cars and autonomous drones, in turn driving demand for edge-compute algorithms. This feedback loop runs both ways; hardware breakthroughs can enable new software and create entirely new physical form factors and blue-ocean markets.

Today, the gospel of software maximalism has fewer disciples.

Deep tech’s share of VC has doubled from ~10% a decade ago to over 20% today (or 35-40%, if you count AI infrastructure). A generation of founders and investors are coming of age tackling hard technical problems that can’t be commoditized overnight, built on fundamental advances in technology, physics, chemistry, and materials science.

This shift changes everything for venture. Deep tech often demands years of technical validation, product development, pilot scaling, and regulatory navigation before a product can ship. It demands patient capital, consumes significant upfront capex, and rejects evaluation by Moneyball-like playbooks.

This is the central tension of the new era: the capital stack built for bits is now reconfiguring for the world of atoms, creating a dynamic of both immense opportunity and significant friction.

Section 002

The New Venture Landscape: Consolidation, Scarcity and Contradiction

The funding landscape that deep tech founders must now navigate today is not the specialized bazaar of old, but a concentrated oligopoly. Sand Hill Road’s gentle boutiques have made way for entities that operate more like sovereign wealth funds than traditional partnerships.

This is a market defined by the gravitational pull of the megafund, the structural scarcity of specialized capital, and the punishing arithmetic of scale.

The Megafund Migration

VC has undergone its own version of Moore’s Law in reverse: as technology companies demand exponentially more capital, only exponentially larger funds can compete.

The result is a level of market concentration that would make Standard Oil blush. In 2024, just nine firms absorbed nearly half (46%) of all U.S. venture capital funding, while the top 30 captured ~75%. It’s power laws all the way down!

The New Price of Admission

Next-generation deep tech companies (and frontier labs especially) need staggering amounts of capital.

Training GPT-4 cost an estimated $78–$100M in direct compute expenses, with fully loaded costs (including supporting experiments and R&D) in the $100-$200M range.

First-of-their-kind SMR units are projected to require $300M-$2B in capital before regulatory approval and commercial deployment (though this highly depends on reactor size, regulatory pathway, and complexity).

Advanced material companies – carbon fiber, novel alloys, engineered ceramics – typically require $50-$200M before reaching commercial production scale (large, repeatable market sales).

This creates a powerful, self-reinforcing cycle. Ambitious founders, knowing they will need immense follow-on capital, are incentivized to partner with megafunds from day one. This gives giants privileged access to the most promising deal flow, which in turn attracts even more capital from LPs who want to back perceived winners.

The Punishing Math at Scale

But bigger isn’t easier. The basic arithmetic of VC becomes punishing at this scale:

A $100M fund needs five successful investments averaging $60M in proceeds to generate a 3× return.

A $5B fund needs five investments averaging $3B in proceeds each, requiring portfolio companies that achieve exit valuations of $15-$20B.

This creates a winner-take-all dynamic with a twist: the winners must become historically unprecedented winners.

A billion-dollar exit, which might be a career-defining success for a founder or smaller fund, is a rounding error for a megafund. You need your winners to achieve $15-20B valuations. Effectively, you’re betting that you can find among the most valuable enterprises created in human history.

The Great Consolidation

The trend towards ever-fewer, ever-larger funds, which we’ll call The Great Consolidation, is driven by deep structural forces that are systematically squeezing out the specialist and emerging venture managers. Unfortunately, these are precisely the types of people who could be key drivers in the deep tech renaissance.

Emerging managers, or firms with fewer than three funds, are often run by former engineers, founders, operators, or scientists. Their share of total VC fundraising plummeted from 50% in 2017 to just 20% last year.

The data makes it seem as if these managers are going the way of this:

A Distribution Drought

In the last cycle, LPs have fled from risk-taking and reallocating to brand and scale. This “flight to quality” runs deeper than simple risk aversion. It’s a rational response to a severe liquidity problem within the asset class.

A prolonged exit drought has left LPs cash-starved and overexposed to illiquid venture investments. Those who committed capital during the 2020-2021 go-go times are still sitting on uncalled commitments they must honor, while un-exited assets pile up and they receive minimal distributions from existing funds.

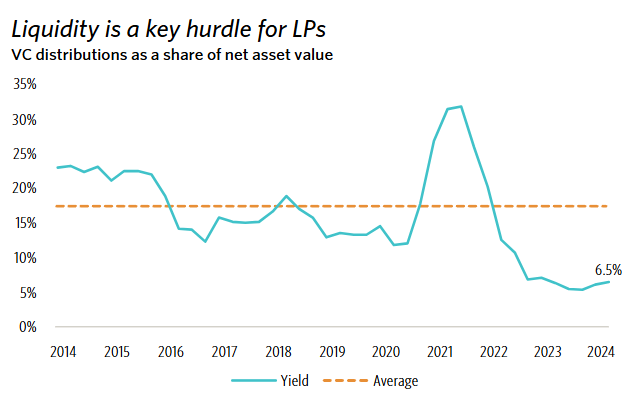

Cash distributions hit a post-GFC low in late 2023/early 2024, returning just 6.5% of NAV, a steep drop from the 15-20% seen in recent years.

This crunch is compounded by longer time horizons, as companies now age 10+ years before exiting, stretching the timelines of top-quartile funds to an unprecedented 16-20 years (nearly double the traditional cycle).

These conditions have spawned a growing horde of funds that exist in suspended animation, unable to write new checks but still collecting management fees. Active firm counts are down markedly over the last five years. More and more “zombie” funds walk among us, distorting performance data, tying up LP bandwidth, wasting founders’ time, and crowding out emerging managers.

So, what’s an LP to do?

Well, if they haven’t received distributions from existing funds, how do you think they’re going to feel about committing capital to new funds, particularly unproven emerging managers? Not great, Bob!

For a cash-starved LP, the “flight to quality” has a clear rationale. With little capital to recycle, they’re naturally gravitating toward established funds with pre-existing relationships, staying power, and mature portfolios that might generate near-term liquidity. This creates a cycle: the lack of exits pressures companies to raise larger rounds, which further favors the megafunds, reinforcing the very consolidation that sidelines specialists and smaller vehicles from the ecosystem.

Recall that emerging managers often have the specialized expertise, operational experience, and sourcing networks that larger firms lack. If you’re an emerging manager with these qualities, there are a lot of reasons a founder in your wheelhouse may want to partner with you. But ultimately, those reasons may mean diddly squat if a megafund can swoop in and outbid you by 50–100%. As multi-stage firms elbow into earlier stages, this is not a hypothetical.

Thus, a three-year-old fund with a very promising portfolio may nonetheless still have to close its doors — not from poor performance, but structural irrelevance.

The Solo Capitalist Advantage

While consolidation is the dominant trend, a countercyclical breed of “super-solo GPs” has burst onto the scene, representing a compelling adaptation for the deep tech era.

This model, popularized by investors like Elad Gil, puts a single technologist-investor in the driver’s seat without traditional partnership structures. Super-solo GPs offer three key advantages that may be well-suited to the challenges of deep tech investing

- Incentive alignment: They often invest personal capital alongside LP funds, ensuring every decision reflects true conviction rather than compromise by committee.

- Speed and focus: Absent partnership votes, term sheets can translate into signed deals within days, and investment theses can be more focused and consistent over time.

- Domain expertise: These GPs typically possess the requisite operational chops or technical acumen, as former founders/leaders in their field. This allows them to maintain specialized expertise and call on tight networks.

While centralizing risk on one individual, this model is proving its worth. Solo GPs now represent over half of all emerging fund managers, and their early-stage success rate is impressive, attracting increased attention from LPs looking for better risk-adjusted returns than traditional partnership structures.

Inflation Comes for Everything, Including Venture Rounds

Round sizes have grown faster than funds themselves, creating a scissor effect that squeezes smaller managers out of meaningful stakes.

The arms race is driven by several forces. Multi-stage giants are willing to pay premiums immaterial to a billion-dollar fund but fatal to a $50M specialist.

And often, the most promising newcos from established founders set higher and higher bars. Companies like Anduril, Boring Company, or Redwood Materials “launched,” they did so with valuations of $60M, $1B, and $200M, respectively, which are valuations well beyond what any emerging manager can meaningfully access.

For emerging managers, this trend is an existential threat. The $50M fund that once led a $10M round now finds itself relegated to a small slice of a $50M financing, unable to secure the ownership needed to justify its existence to LPs.

The perverse incentives can cascade to founders, who, after raising $100M at a $500M valuation, need multi-$B exits for their investors to see meaningful returns. This narrows the range of successful outcomes and forces founders towards winner-take-all markets where only the largest survive.

Taken together, these trends have sidelined specialists and smaller funds, systematically taking key technical capacity off the chessboard.

This could produce a funding gap for promising early-stage deep tech companies that do not pattern-match, but nonetheless need patient capital and sophisticated technical guidance.

How are they supposed to compete for the attention of generalist investors with more bets in their portfolio?

Section 003

Tribal Knowledge & AI

Do Domain Knowledge Deficits Matter?

Your friendly neighborhood VC can model SaaS multiples in their sleep and benchmark churn on the back of a napkin — but ask them to underwrite technical risk of an early-stage spinout team working on battery chemistries, and you’ll get this look:

This is the fundamental bone to pick with the current venture model. Its prosaic spreadsheets offer little value when the real work is happening in laboratories, fabs, and factories. And America’s future hinges on technologies that refuse to scale on software alone: reactors, accelerators, alloys, and so on. Alas, the fundamental issue is that fluency in growth loops ≠ literacy in physics.

The split starts at evaluation. Software businesses can be judged on adoption curves, unit economics, and market penetration. Hard tech requires first-principles checks: does the science close; can it be manufactured at yield; will it clear qualification and regulatory gates; what are the credible failure modes over a multi-year horizon?

Support requirements are equally disparate. Deep tech companies might need help forging relationships with national laboratories, established OEMs, and Tier 1 industrial suppliers, which requires understanding complex procurement cycles, regulatory environments, and technical validation processes. A deep tech startup may call on their investors to assist with recruiting materials scientists and manufacturing engineers – talent pools with entirely different sourcing strategies, compensation structures, and retention approaches.

A generalist with networks in software engineering and product development may not be able to help a founder find someone who understands lithography processes or superconducting materials.

Investors without domain expertise can provide capital but may not be able to add strategic value, potentially slowing company development and reducing the likelihood of successful outcomes.

And what about AI?

Of course, in a VC thinkpiece about VC, it’d be a crime to not write about AI, right? In fairness, it belongs in this discussion for two reasons:

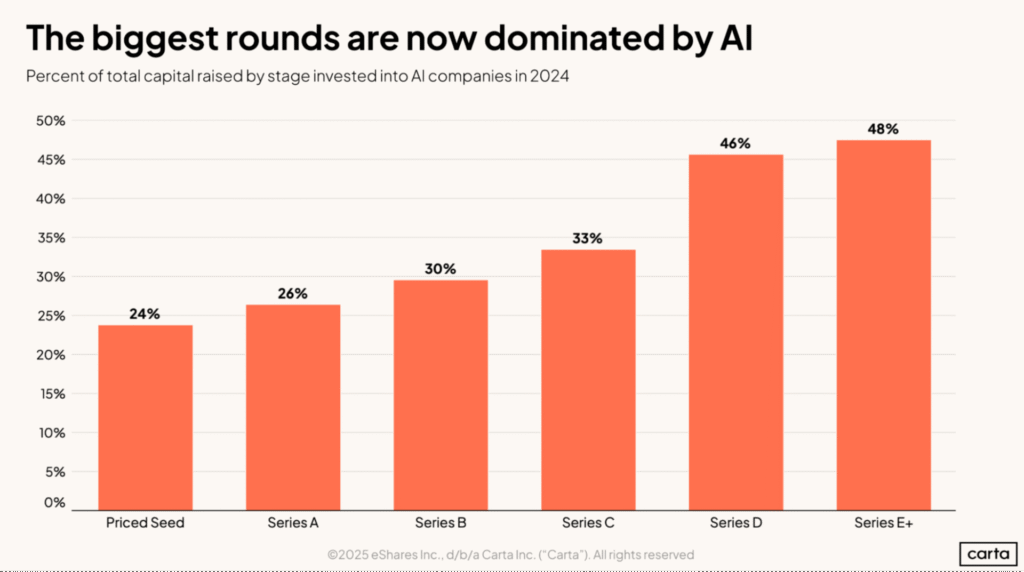

- AI today is propping up the entire venture industry…and public equities…and the United States of America’s economic growth forecasts. In 2024, AI-related companies raised roughly a third of global venture dollars and American AI startups raised $110B in VC! On the upside, the prize is enormous — Pascal’s wager and whatnot, with trillions of economic value that could flow from strong AI systems.

- But this concentration cuts both ways. On the downside, if frontier models disappoint, we slip into the trough of disillusionment, and the Nasdaq enters correction territory, uh oh. A serious downshift freezes new LP commitments, deepens the existing distribution drought, and slows dealmaking across the ecosystem, as both startups and VCs are heavily levered to AI’s continued success.

In the near term, AI could invert parts of venture’s economics. Company formation is cheaper as code, tooling, and copilots compress headcount and cycle time (and yes, this applies to hardware companies). This favors smaller, more capital-efficient firms rather than ever-larger rounds. AI can already partially automate or greatly augment sourcing, diligence passes, market landscaping, and portfolio monitoring — giving specialist boutiques (or sharp solo GPs) more reach per dollar. This could help alleviate the great compression, as megafunds are met with an equal and opposite force: technical capital armed with better tools.

Section 004

Three Possible Futures

SCENARIO 1: Goliath Tightens His Grip

The big get bigger. Megafunds consolidate VC, PE, and credit under one roof and standardize how risk is underwritten. They can write massive checks — $200M seed rounds, $1B Series A’s — but evaluate companies with standardized, templated playbooks not optimized for physics or qualification. Smaller, specialized funds become an endangered species. Contrarian theses thin out, and hard-tech innovation cycle time slows. Capital arrives without know-how, and increasingly concentrates among companies that fit standard models and can attract attention from megafunds.

SCENARIO 2: VCs Disrupt Themselves

Fate loves irony, and in this scenario, the equalizer arrives from inside the house. The very technology fueling megafunds’ markups – AI – helps level the playing field by collapsing the back office. A specialist renaissance kicks off, with domain boutiques and sharp soloists punching above their weight. They compete on speed and outmaneuver with depth at earlier stages. They can scale technical/scientific capacity and surge support to portfolio companies in a way that generalist funds cannot. The ecosystem benefits from more dispersed, bottoms-up dealmaking, more diverse cap tables, and faster de-risking, because money shows up with the relevant craft and know-how attached.

SCENARIO 3: A Bifurcated Universe

The ecosystem stratifies by function: megafunds and crossovers dominate later stages and earlier rounds for the “chosen” deep tech/scientific/industrial sectors, serving as the de facto capital partners for companies looking to go big. Early stages, meanwhile, are energized by a more vibrant “technical capital” bench of specialized funds, solo GPs, and AI-augmented boutiques, focused where domain expertise matters and the biggest, non-obvious bets are overlooked by generalists. This yields a more complex but resilient landscape for founders, who also have access to an expanding arsenal of non-dilutive financing options: debt, bespoke credit, and new government vehicles. These strategies could allow startups to scale production, retain control, and engineer growth on their own terms. Ideally, this universe lets founders pair specialized early support with the capital firepower of growth funds as they mature — maximizing both technical guidance and financial muscle at every stage.

Section 005

Where Do We Go Next?

What started as a partnership between audacious industrialists, restless financiers, and tinkering engineers who delighted in defying conventional wisdom has matured into a sanitized asset class whose center of gravity sits on the balance sheets of global financial behemoths.

Investors like to think in binaries. So, let’s posit that we’re at a fork in the road:

- One path leads to further consolidation, where capital is abundant but conviction is scarce, and standardized playbooks slowly suffocate contrarian ideas.

- The other demands a deliberate reversal: a renewed focus on specialization, diversified sources of capital, and technical BS detectors.

Whatever the path, winning will require adaptation from all live players.

Founders.

You face a harder fundraising market that rewards preparation and precision. Earlier on, a good question to ask yourself is not how big of a round you can put together, but whether the investors attached to it can help you cross the next technical gate (or, whether you need that help at all). If you need true “value-add” investors here, model the tradeoffs between domain fluency and check size. Smaller rounds from specialized/strategic backers may handily beat larger sums from generalists who can’t help you qualify a process, secure a government contract, or recruit the right electrochemist. Be mindful of the signal value of your cap table, and whether it might complicate the next raise more than it helps the current one. And assume longer cycles. Relationships should be built months or years before you need to raise.

LPs.

You face a complex balancing act between the perceived safety of megafunds and the opportunity in specialized vehicles. The former offers predictable but more conservative outcomes — scaling laws make superior returns harder as funds size up. Diversifying into specialists, particularly in deep tech where domain knowledge and networks are decisive, means doing more work upfront, adopting a longer lens, and potentially building a technical bench, but it also opens access to outcomes the largest pools routinely miss. In a distribution drought, portfolio construction and pacing matter: think about how specific theses might sit within the broader mandate rather than following the fundraising trend de jour.

VCs.

We ourselves are being forced to pick a lane. The mid-sized, generalist middle is the most vulnerable place to be right now. Scaling to compete with megafunds implies a different business (and a difficult proposition). Specializing implies recruiting partners with real technical pedigrees, embedding in industry ecosystems, and building evaluation and support capabilities that travel from one company to the next.

Conclusion

Building for the Next Quarter Century

Decisions made in the next few years — by founders selecting investors, by limited partners shaping exposure, by partnerships choosing to scale or specialize — could decisively influence whether the U.S. sustains technological leadership and regains its edge in critical hardware-intensive industries, or cedes further ground to its chief rival.

The world’s largest technical-capital megafund, the CCP, is deploying hundreds of billions through a curious hybrid approach. While priorities are set at the highest levels, China unleashes fierce internal competition among regions, researchers, labs, startups, and tech companies, locked in battles where only the strongest solution survives. Take the “Hundred Model War” (百模大战), where hundreds of AI companies ruthlessly battle to field the best foundation models. It’s orchestrated Darwinism: the state selects the battlefield, floods it with capital, then lets natural selection work its magic.

It’s an odd twist on capitalism, creative destruction, and competition, and an exquisite irony that China is attempting to wield the same forces that have made U.S. invention and innovation unstoppable — precisely as America’s venture ecosystem consolidates and homogenizes.

The convictions (perhaps, biases) of this Antimemo are clear: consolidation risks narrowing the distributed, bottoms-up, and heterodox approaches that have historically driven American breakthroughs; deep tech requires patience and expertise that many investors lack; and the distribution drought is exposing fundamental contradictions in the basic economics of the asset class.

But hope springs eternal, and reasons to be optimistic abound. With new industrial programs, reshoring demand, and a generation of engineers hungry to build, deep tech is delivering both real returns and real American capacity. Procurement is creaking open. Customers are signing real offtake agreements. The specialists who haven’t been sidelined or scared away are regrouping with sharpened focus. AI is lowering the barrier to entry. And we’re seeing generational demographic tailwinds, as talent from Big Tech, in search of greater meaning and purpose, matriculates into deep tech.

The renaissance in hard pursuits is underway. Our task now is to finance it with discipline, staff it with expertise, and carry it to scale.