Introduction

Foreword

For more than two centuries, the value of American land has obeyed a law as reliable as physics. The closer you were to a city, the more your land was worth. Distance was a tax. Every extra mile shaved dollars off the price.

The law, as old as the Republic itself, shaped our maps, migration patterns, local economies, and sense of what a place was worth. It was reinforced by every wave of infrastructure. Rail. Highways. Then broadband. Faster connections always reached dense urban cores first, making location and connectivity two sides of the same premium.

Now that law is under quiet assault from 340 miles overhead. After decades of false starts, low Earth orbit broadband is here. Led by Starlink, these fleets can beam city-grade connectivity to the places that fiber and capital forgot. The digital penalty of distance is starting to vanish.

And the physics invert the old order. Shared-capacity networks perform best where user density is lowest. The most remote ranch or mountain valley can claim digital infrastructure equal to, and sometimes better than, the ‘burbs.

This is not simply a story of technological determinism or economic arbitrage. There is a human and social element to this story. A satellite link can deliver a Zoom call, but it cannot deliver a community, or school system. It cannot replace the intricate, hard-won social fabric that makes a place a home.

The question is what happens when broadband parity becomes universal. Does this law get repealed? Does the proximity premium erode? Does the price map of American land get redrawn?

This Antimemo argues that it might. The frontier feels alive again. Not a frontier of covered wagons, but of bandwidth, beams, and batteries. Our central thesis is simple: once you kill the connectivity penalty, distance is no longer destiny.

Here, we will:

- Trace the path that brought LEO broadband to this moment

- Examine how it intersects with the tyranny of the last mile

- Model where, how, and when land values might re-rate

- Explore the other tailwinds driving this (as well as risks)

If the law is truly breaking, we could be at the forefront of one of the most significant redistributions of opportunity since the highway era. What follows is our attempt to see the shape of it early.

But first, a story about failure — because, before we can understand what makes this moment different, we need to visit the graveyard of those who tried and failed to light the sky before.

Section 001

How the sky learned to carry the load

The ambition to blanket the Earth with a celestial web of communication satellites is not new. But until recently, it was a graveyard of failed ventures and spectacular bankruptcies.

In the mid-to-late 1990s, a slew of LEO ventures companies like Globalstar, Teledisic, and Skybridge collectively burnt north of $10B and launched a few hundred satellites, only to spectacularly flame out. Globalstar, with 48 satellites, went bankrupt in 2002. Bill Gates-backed Teledisic, eyeing 840 “internet-in-the-sky” sats, collapsed after the dot-com crash without reaching object. Plenty more paper projects, such as SkyBridge and Ellipso, succumbed to fundraising and regulatory hurdles before launching a single satellite.

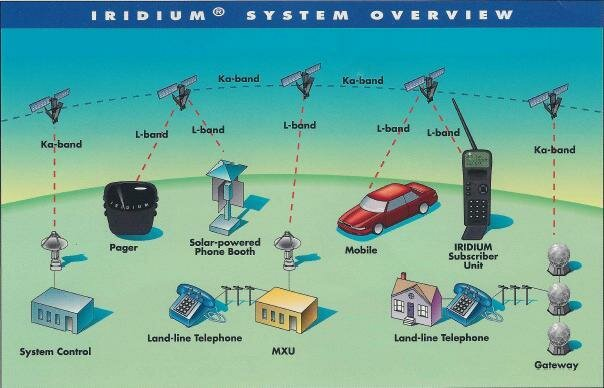

The poster child of this era was Iridium. Conceived in 1987 by Motorola as a global satphone network, Iridium deployed 66 cross-linked LEO satellites into an elliptical orbit by 1998. Despite pulling off an unprecedented technological feat, conducting the most successful launch campaign in history, and achieving flawless orbital coverage, the unit economics were brutal. Iridium spent $5B to launch the voice network. Handsets cost $3,000 and weighed a pound. Iridium charged $7/minute for calls, which was a tough pill to swallow in an era of rapidly expanding terrestrial cellular networks.

By mid-1999, Iridium had only attracted ~10,000 subscribers, far short of the 500,000+ needed to break even. After defaulting on $1.5B in loans, the company filed for Chapter 11 in August 1999 with $4.4B in total debt. It was one of the largest bankruptcies in American history at the time. Motorola wanted to be done with the whole thing, and almost got its way, nearly deorbiting the $5B fleet (which cost $40M+ a month to operate). As the deorbit command loomed, an eleventh-hour acquisition bid led by Dan Colussy saved Iridium – thanks in no small part to quiet support from the White House and pressure from the Pentagon to preserve global satphone capacity for national security applications.

The miscalculation was timing. When Iridium began launching from American, Russian, and Chinese rockets (the ‘90s truly were a different time), global cell phone usage stood at 300M. Iridium had built a solution for global satellite telephony before figuring out who actually needed it. It was marketed heavily to the elusive “global business traveler,” but found more niche adoption among sailors, scientists, and survivalists. Iridium’s management later admitted they “built a marvel before figuring out how to make money on it,” and analysts pegged it as a classic MBA case study in how not to launch a product.

The obstacles went beyond product market fit. Rockets cost $50,000 per kilo to launch. The web ran fine on 56k dial-up. Most customers were perfectly served by rapidly expanding terrestrial networks. And the “bent-pipe” architectures of most systems made for clunky, expensive handoffs to terrestrial networks. Iridium’s more advanced in-space switching was an engineering triumph but an economic foil.

By the early aughts, the dot-com crash decisively choked off risk capital. Investors weren’t going to touch a LEO venture with a 10-foot pole. The dream of internet-from-space seemed dead.

And then, everything changed.

Led by Starlink, today’s megaconstellations are viable not because the vision is new, but because four decisive enablers finally arrived:

001 // Market pull: The 1990s ventures were a technology searching for a market. Today, the demand is no longer for satellite telephony but for ubiquitous, high-speed broadband internet. Today, this is a well-defined problem: 5.5B people are online; 2.6B are not. The internet is now a utility, and terrestrial solutions cannot economically reach the margins.

002 // Space access. Reusable rockets, pioneered by SpaceX and ushered in by the Falcon 9, have collapsed launch costs and turned replenishment from crippling capex into manageable opex. LEO satellites have a limited lifespan of five to seven years, due to atmospheric drag, so constellations need constant replacement. This feeds a sustainable cycle. Frequent, affordable launches → rapid deployment → constant iteration on satellite design.

003 // Technology maturity. Advances in miniaturization, materials science, and electronics have enabled the development of smaller, cheaper, and more capable satellites that can be mass-produced. Phased-array antennas, which can steer beams electronically, and inter-satellite laser (ISL) links, which create a data-routing mesh in space, deliver a level of performance far beyond what was conceivable in the 1990s.

004 // Latency demand. The web itself has changed. Dial-up was tolerated in the ‘90s. With today’s cloud apps, video, gaming, and real-time workflows mean that every millisecond counts. Latency is a billable commodity. No longer just a specification, nor technical luxury. This economic requirement provides the powerful demand-side pull that the earlier wave of ventures so fatally lacked.

The failures of the 1990s were not for lack of imagination. They were victims of cost curves, physics, and premature markets. The success of Starlink and its peers rests on enablers that simply did not exist a generation ago.

Section 002

The tyranny of the last mile: A mile spectrum of disconnection

Rural America remains trapped in digital poverty not by accident, but by the brutal economics of distance and density that make traditional connectivity solutions uneconomical. The result is a spectrum of exclusion that legacy technologies have proven unable to close.

It’s not just an American problem. Globally, 2.6B people remain offline, nearly a third of humanity. This cuts across predictable industrialized lines. In high-income countries, 93% of people are online. In low-income nations, it’s only 27%. The so-called digital divide is less a gap than a cliff: those on one side enjoy full participation in modern life, those on the other are locked out.

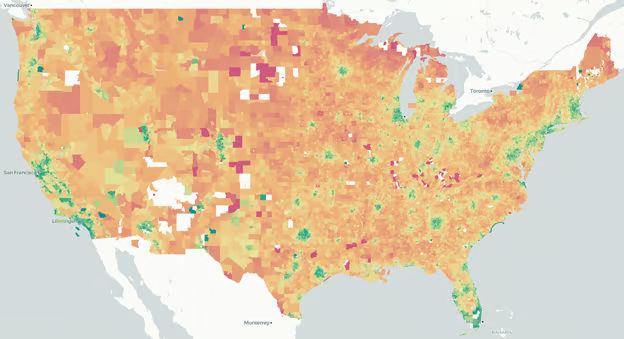

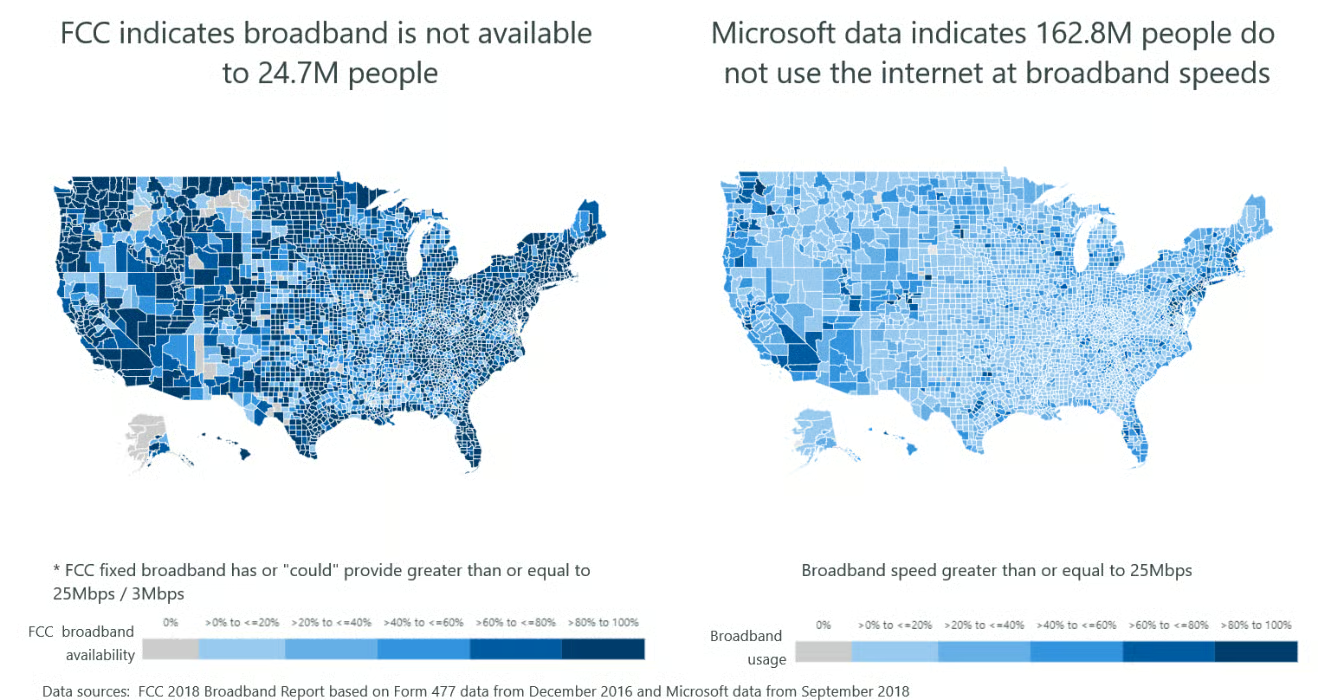

The divide hides in plain sight in the developed world: it’s the yawning gap between fiber-fed metros and the rural hinterlands. In the U.S., 43.7M Americans (13.3% of the population) lack access to modern broadband/mobile services. Urban broadband clears the new FCC standard of 100/20 Mbps almost universally. Rural America lags badly.

The divide isn’t a simple on/off switch.

To truly grasp the scale of the problem, you must understand that “broadband” is not a monolith. It’s a spectrum where different speed thresholds unlock vastly different tiers of participation in the digital economy. This was formally acknowledged in March 2024, when the Federal Communications Commission (FCC) officially quadrupled its definition of baseline broadband from 25 Megabits-per-second (Mbps) download and 3 Mbps upload (25/3) to a more modern 100/20 Mbps standard.

- Tier 1: The Digital Poverty Line (Below 25/3 Mbps): Below this old FCC benchmark, the modern internet is largely inaccessible. Email works; video calls don’t. A single 4K stream is impossible. This is the reality for 22.3% of rural Americans and 27.7% of those on Tribal lands: effectively locked out.

- Tier 2: The “Underserved” Buffer Zone (25/3 Mbps to 100/20 Mbps): The zone of constant compromise and frustration. A single person may be able to function — but a family cannot. A 25 Mbps connection is consumed entirely by one 4K stream, leaving no bandwidth for others.

- Tier 3: The Modern Standard (100/20 Mbps and Above): Now the accepted threshold for full participation in the digital world. This is the standard that unlocks the true potential of the internet as a utility: multiple 4K streams, seamless video calls, and remote work without compromise. While 98% of urban America clears this bar, nearly one in four rural households do not.

The true scale may be worse than the statistics let on. The FCC considers an entire census block “served” if just one location within it could receive service. In sprawling, sparsely populated rural areas, this masks reality for hundreds of unserved homes, inadvertently diverting funding from the places that need it most.

The decades-long ground war against distance and density

This tiered system of digital exclusion persists because the ground war to connect rural America has been a long, costly, and often losing battle fought on multiple technological fronts.

Why has this proven so hard to fix? Because every terrestrial option struggles against the fundamental economics of distance and density:

- Fiber-optic cable: the gold standard, gilded in cost. Universally hailed as best-in-class technology, fiber offers unparalleled speed, reliability, and future-proof capacity. With a 50-year lifespan and no signal degradation over distance, it’s the undisputed champion of broadband. But deployment costs are staggering, averaging $27,000 per mile and often running much higher. In rural areas, the cost to run fiber past a single home can be $3,000–$6,000, an order of magnitude higher than in a city. This brutal economic reality – profitable in cities, prohibitive in the countryside – has made large-scale private investment in rural fiber a non-starter without subsidies..

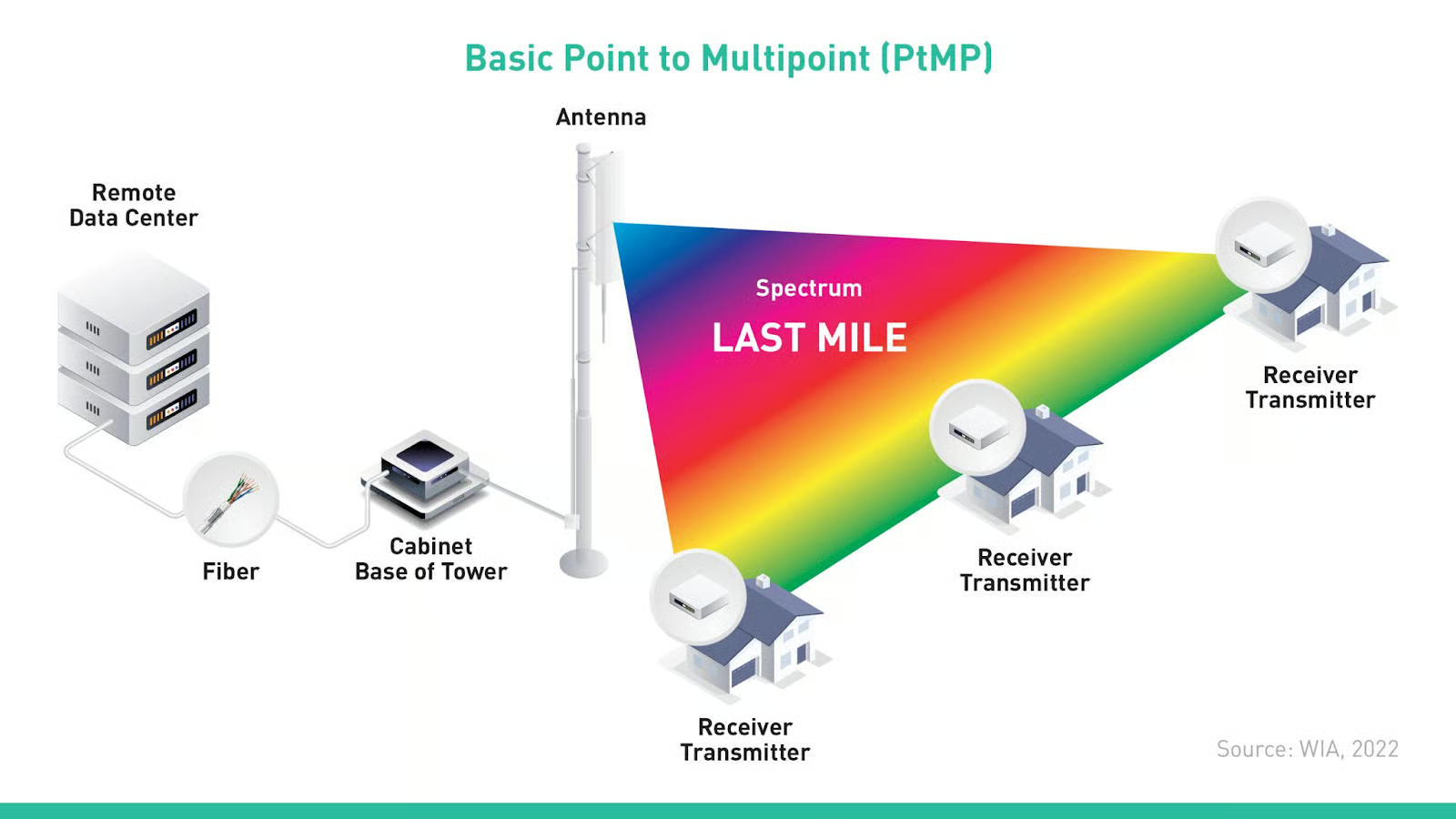

- Fixed wireless access (FWA): the challenger in the air. FWA, including 5G FWA, beams internet from a central tower to receivers on individual homes, bypassing costly trenching and enabling much faster/cheaper deployment. In areas with a clear signal, it can deliver 100+ Mbps speeds. But FWA’s reliance on radio waves means that hills, dense forests, and even seasonal foliage can obstruct the required line-of-sight, degrading or blocking signals entirely.

- DSL and Cellular: the legacy stopgaps. For many rural residents, the only options have been legacy technologies. Digital Subscriber Line (DSL) leverages existing copper phone lines, but its performance decays dramatically with distance from a central office, often leaving users with speeds insufficient for modern needs. Cellular hotspots and phone tethering offer portability but are hobbled by the very problem they are meant to solve: weak rural cell coverage. Furthermore, restrictive data caps and throttling make them unsuitable as a primary home internet solution.

- Electric co-ops: solving for a different problem. More than 250 rural electric co-ops across the country are now deploying broadband. As community-owned nonprofits, their mission is service, not profit maximization. And they own essential infrastructure (utility poles, rights-of-way, and distribution: a direct relationship with every household), which can significantly cut the costs and complexity of a fiber buildout. While this route shows promise, it still struggles in the most remote, sparsely populated service areas.

The tyranny of the last mile is not just about the financial difficulty of running fiber to a farmhouse. It is the compounded human cost of being stranded on the wrong digital cliff, dictating whether a student can join a classroom or a patient can see a doctor.

Breaking that tyranny requires something different: a platform that is fast, terrain-agnostic, and globally scalable. Until very recently, that lived in theory. Now it lives in orbit.

Section 003

Enter the great connectivity equalizer

LEO satellites invert the economics of connectivity. Unlike terrestrial networks, which thrive on density, shared-capacity LEO systems perform best where user density is lowest.

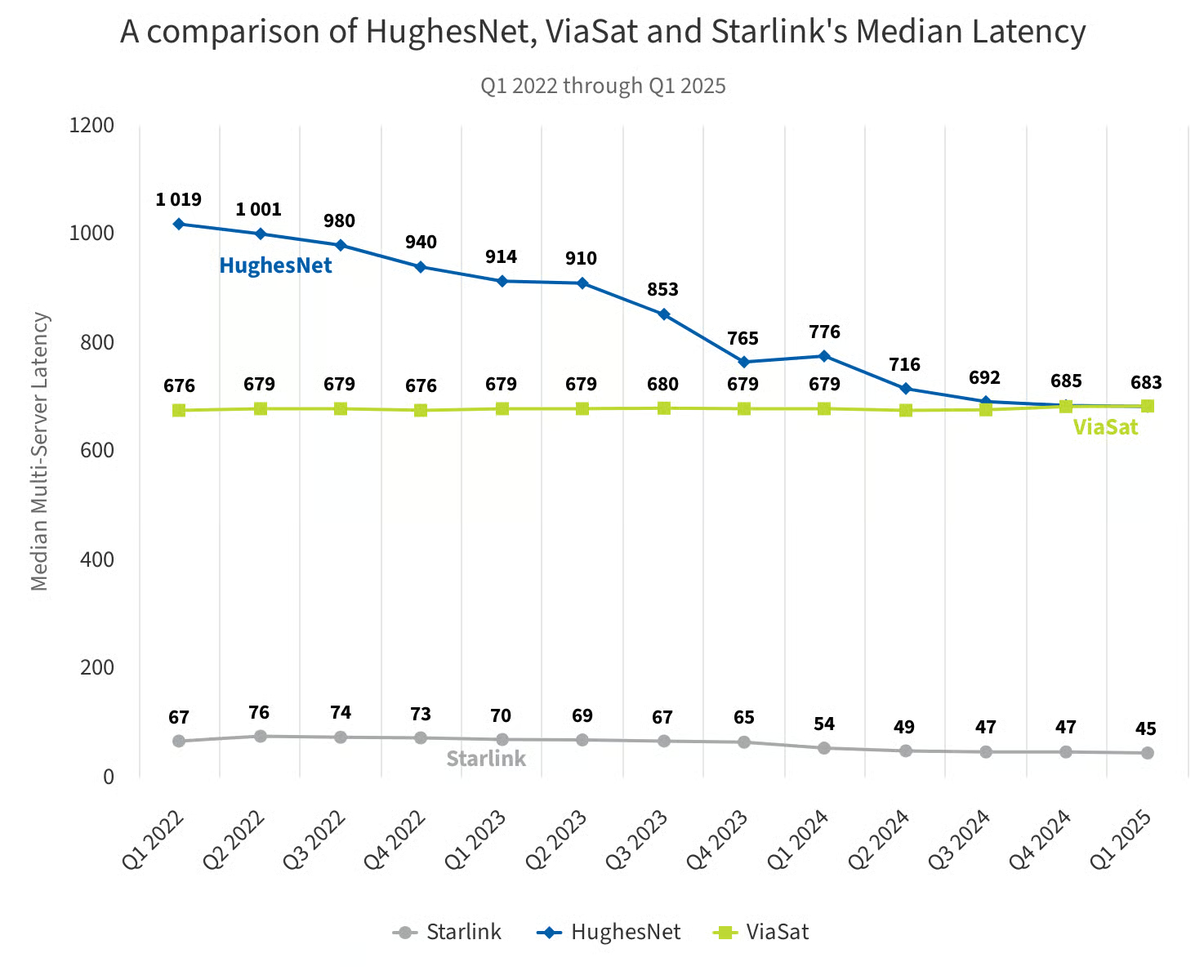

The physics are straightforward: proximity is performance. We’ve neglected to mention that for decades, satellite internet was synonymous with a small number of geostationary (GEO) spacecraft, parked 22,250 miles (36,000 km) above the equator. GEO’s high perch gives each satellite a wide field of view, enough to blanket a continent, but it comes at a cost: crippling latency. A signal must climb to orbit, travel across that arc to a ground station, and return, adding over 600 milliseconds of round-trip delay. That’s acceptable for bulk file transfers but fatal for modern interactive use.

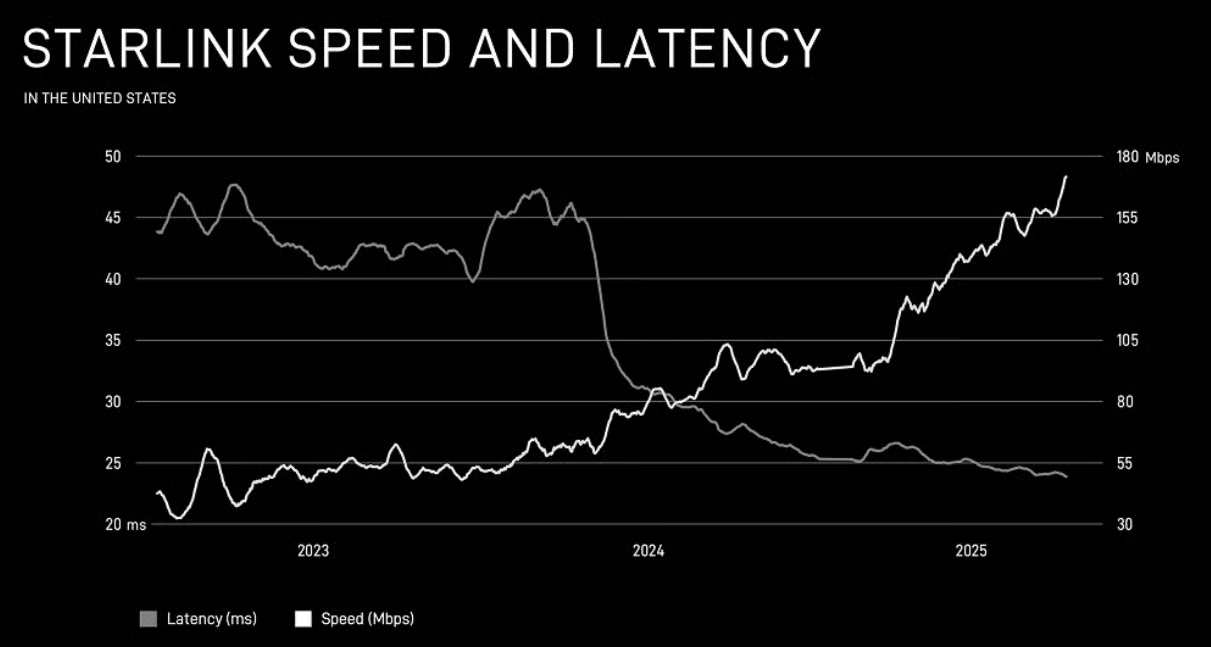

LEO systems flip the geometry. Starlink’s satellites orbit at roughly 340 miles, one-sixteenth the distance to GEO, handing off connections as they circle overhead. The physics advantage is enormous: median U.S. latency on Starlink hovers around 25–30 ms. While download speed gets the marketing attention, this latency reduction is what transforms satellite internet from a frustrating last resort into a viable replacement for terrestrial broadband.

The architecture also changes the bandwidth equation. GEO providers’ entire customer base shares the finite capacity of a single spacecraft. LEO disperses that load across thousands of networked satellites, each linking to multiple ground stations and increasingly to each other via ISL lasers. The result is both higher aggregate throughput and more graceful handling of regional demand spikes.

This performance chasm has triggered a GEO death spiral. Predicated on a few extremely expensive, high-risk satellites, trapped by physics, and unable to compete on latency or throughput, legacy providers’ business model is fundamentally fragile. The attrition is visible: since Starlink’s launch, Viasat’s fixed broadband subscriber base has dropped by 56–68% and HughesNet has last ~44%. For consumers, the GEO era is over.

Starlink is available everywhere. The only non-negotiable is an unobstructed view of the sky. If you can point a dish clear of trees, canyon walls, or buildings, you can pull the same service on a fishing trawler, in a desert mine camp, or from a cabin in the backcountry.

That universality is table stakes, but the real arbitrage is subtler. Each satellite projects a finite number of spot beams, and each beam’s total throughput is sliced among the active terminals within its footprint. The fewer users in that footprint, the larger the share of capacity each one gets. This creates an inversion of the terrestrial broadband model.

Looking ahead, today’s Starlink capacity will look quaint within a decade. Today, the fleet delivers ~500 terabits per second (Tbps) of busy-hour capacity. Recent Mach33 modeling translates that to roughly 0.10 gigabits per second (Gbps) of engineered capacity per square kilometer, at an effective cost of about $4,976 per Gbps·km²·year. At that density, a cell saturates at around 10 connected premises per square kilometer. Fiber, by contrast, gets cheaper per delivered Gbps as more premises share the plant, and it remains the most economical choice once you hit town-like densities.

Mach33’s projections point to a 40x jump in Starlink’s capacity (to ~20,000 Mbps) driven by two compounding step-changes:

- V3 Starlink satellites. Each V3 bus targets roughly an order‑of‑magnitude more throughput than a V2 Mini, with better Gbps/kg and $/Gbps to build and launch.

- Starship launch cadence. High-mass, high-frequency flights radically increase the “bits to orbit” rate. A single Starship can loft ~60 V3 satellites, each at ~1 Tbps, putting ~60 Tbps aloft per mission. This is roughly the same bandwidth as 22 Falcon 9 Starlink launches…in just one shot.

Together, they collapse unit costs, expand density thresholds, and make LEO competitive with fiber up to ~800 premises/km²..

- First, unit cost collapses: by 2030, the cost per Gbps·km²·year could fall to ~$1,076, making Starlink competitive with fiber until density approaches ~800 premises/km².

- Second, capacity density rises into the 1.5–5.0 Gbps/km² range (10–50x today’s figure) providing far more headroom before saturation.

- Third, density thresholds expand: even selling 500 Mb/s plans (5x current speeds), the network could support 80–125 subscribers per km² without hitting the wall. At 100 Mb/s, the theoretical ceiling exceeds 500 subs/km².

(Breaking the fourth wall for a moment: Mach33 treats V3 performance targets and an aggressive Starship launch cadence as essentially bankable. At Per Aspera we’re a shade more circumspect: impressed by the trajectory, but alive to the execution risk inherent in fielding a new bus at scale while simultaneously ramping an entirely new heavy-launch architecture. The broad direction of travel is clear; the exact slope, less so.)

Starlink, Kuiper, and peers will not remain confined to the farthest farmhouses. As orbital supply grows, the serviceable geography moves steadily inward — and the technology pencils out for exurbs, small-town fringes, and the like. That shift collides with old real estate logic.

What happens when distance discounts no longer hold, and in some cases, flip? Once broadband is switched on, value changes don’t follow capacity charts alone. They move through a set of repeatable mechanisms that ripple into local markets. In the next section, we turn to those mechanisms and attempt to model how, if, and when signals in the sky become dollars on the ground.

Section 004

Form signal to sale price: An attempt to model how LEO broadband rewrites land values

Connectivity premiums get capitalized into property values through measurable mechanisms, with our modeling suggesting 5-10% immediate uplifts when broadband arrives. The biggest gains occur in the 30-100 km sweet spot around metros, where distance penalties soften while city access remains viable.

In North Idaho, parcels that once languished unsold for months are suddenly drawing offers. The difference is a pizza-box antenna pointed at the sky. One broker put it bluntly: “Starlink revolutionizes land value.”

The pattern is spreading elsewhere. Maine distributed 9,000 Starlink kits to its hardest-to-reach homes. There’s no publicly available retention statistics, but we’d expect that most households kept paying after the free year ended. Texas has committed $30M to LEO rural broadband grants. At the federal level, Commerce Secretary Howard Lutnick is weighing changes to the federal $42.5B BEAD program to embrace “technology neutrality,” potentially redirecting funding from fiber-first policies to include satellite providers.

The Evidence Base

A growing body of research confirms that broadband access is capitalized into land values:

- Baseline premium: A University of Colorado / Carnegie Mellon study of 520,000 homes across 1,600 counties found broadband increases medium home value by ~3%, or $5,400 on a median $175,000 home. Multiple academic studies corroborate the link between high-speed internet and a measurable uplift in real estate prices.

- The fiber dividend: Fiber-specific research shows an even greater impact. A Brattle Group analysis for the Fiber Broadband Association Broadband Association’s 2024 study found fiber connections lift home values by up to 14%. Buyers demand a 4.9% discount for homes without it; landlords capture nearly 13% higher rents.

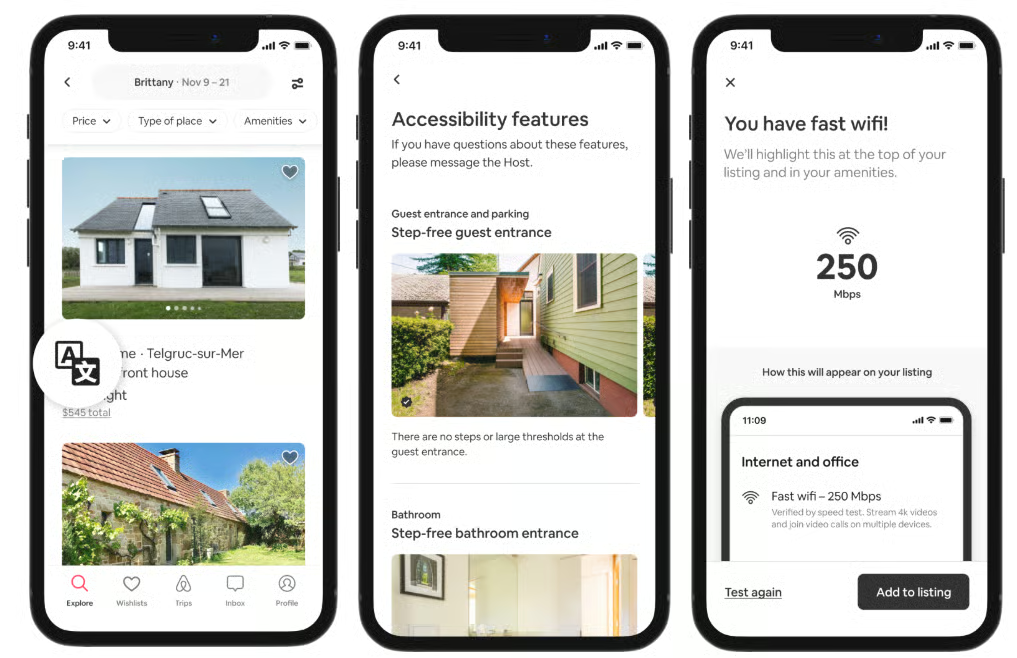

- Amenity demand: Wifi is the second-most-searched amenity on Airbnb, after swimming pools — guests on Airbnb used the wifi filter in 300M+ searches in 2021. For over 22% of the U.S. workforce now remote (more than 32M Americans), broadband is no longer a perk but a prerequisite.

The model

Working with Mach33, we built a framework to map how LEO broadband reprices land. It distinguishes between irrigated parcels with utilities (where development flywheels can spin) and raw parcels with little infrastructure.

At its core:

ΔP(t) = βᴮB + βˢln(S) + βᴅ(1−θᴅQ)ln(D) + f(M(t),A(t),Y(t))

- B (Broadband dummy): Indicator variable that switches from 0→1 when a parcel crosses the ≥25 Mb/s usability threshold.

- S (Speed): the actual bandwidth delivered, in megabits per second (Mb/s).

- D (Distance): How far a parcel sits from the nearest metro, in kilometers, adjusted by Q (Quality factor) that measures how much broadband flattens that distance penalty.

- f(M, A, Y): This term captures the long-term flywheel. Together, these compounding forces can turn a one-time premium into sustained appreciation.

- Migration (M): new people arrive.

- Amenities (A): schools, shops, clinics grow to meet demand.

- Income (Y): higher earnings reinforce the cycle.

Mechanisms at work

- On/Off Premium: Jumping from no internet to ≥25 Mbps delivers an instant 3% value bump ($5,000-$6,000 for a typical home).

- Speed plateau: Higher speeds add value, but returns diminish. The steepest gain is simply reaching usable broadband.

- 25 → 50 Mb/s adds ~$1,450.

- 50 → 100 Mb/s adds ~$1,350 more.

- Economic Spillovers, Amenities, and Migration: Connectivity triggers growth loops. Studies from Indiana show that every rural broadband dollar returns $4 in net benefit. Globally, a 10-point rise in broadband penetration increases per-capita GDP by ~1.2% in developed economies.

The flywheel only spins if the basics are present: schools, healthcare, civic institutions. Families may move for connectivity, but they will leave if schools collapse under new enrollment or if there are no doctors in driving distance. Our model assumes complementary investment in education, healthcare, and civic fabric.

Modeled Scenarios (80 km from metro, 100 Mb/s Starlink)

As discussed, most of the gain comes immediately. The long-term flywheel matters most where land already has water and infrastructure:

Caveats and scale

We deliberately excluded congestion terms, as parcel-level beam load data don’t exist. These uplifts assume households can get ~100 Mbps with ≤40 ms latency during busy hours. Oversubscribed beams will shrink the premium; ultra-sparse beams could exceed it.

The sweet spot sits 30–100 km from major metros: close enough to retain city ties, far enough to capture space and lower cost.

How big could this be? A reality check…

This modeling aligns with early field evidence and anecdata from buyers, brokers, and businesses nationwide, where Starlink’s arrival has made previously unsellable properties suddenly marketable. Still, this is disciplined speculation, not definitive prediction. We’re mapping a hypothesis: that equalizing a historically constrained production factor (connectivity) should narrow traditional price gaps between urban and rural properties.

Our modeled uplifts (5–10%) are conservative. They mirror hedonic studies but may undershoot the upside. Relative affordability gaps between dense metros and rural America are far larger, sometimes multiples. We should not undersell the possibility that what looks like a ripple in the data could become a stampede in practice. So, if broadband parity helps unlock migration into underdeveloped states and counties, the repricing could be far more dramatic.

But one massive caveat endures: broadband removes one constraint but not the others. A dish delivers bandwidth, but it cannot deliver schools, clinics, orchestras, or Little League fields. Value sticks only if digital infrastructure and human infrastructure rise together.

Section 005

The american frontier is alive again

How we navigate this moment will determine whether it sparks a new cycle of opportunity or dissolves into another missed chance.

For the first time in a century, the frontier feels alive again. Not the mythologized frontier and covered wagons of old, but the economic frontier of distance itself. The tyranny of proximity is cracking under converging forces that LEO broadband has helped ignite.

Starlink leads, but Kuiper, OneWeb, and future entrants will follow. And for the first time, rural and exurban America has a credible answer to the urban monopoly on connectivity.

Satellites are the spark, but the fire is already burning.

Families are already voting with their feet, fleeing high-cost metros in search of space, affordability, and sometimes, sanity. Solar and storage make energy independence a backyard reality. Level 4 self-driving is real in urban centers. Level 5 is still far off on the horizon, but when realized, autonomous transportation will further erode distance penalties. All the while, LLMs make it possible to build billion-dollar businesses in the backwoods.

Each of these forces alone would shift markets and settlement patterns. Together, they can redraw the economic geography that has governed American prosperity since the railroad era. We are witnessing the birth of a new American settlement pattern: digitally enabled dispersion replacing century-old agglomeration.

Yet sparks can misfire.

The risks are real. Constellations could hit congestion walls, with oversubscribed beams collapsing back into frustration and customer churn. Regulators may tire of rubber-stamping spectrum allocations. Foreign actors could contest orbital lanes more aggressively. The physics of shared-medium networks means that success breeds its own limitations: too much adoption degrades service for everyone.

Adoption is the governor on this trade. We estimate that about 2–4% of rural American households have mounted a LEO dish. As adoption edges upward, it will put these networks and their promises to a real-world test.

Even if the distance penalty weakens for knowledge workers, it remains severe for nurses, electricians, teachers, and all other professions tied to place. Rural hospitals, schools, and roads designed for decline may suddenly strain under new growth.

And this is not a wholesale migration, in which the United States empties its cities into the countryside. What we are envisioning is fractions — but in thin rural markets, spread across a 342M base of people, fractions are enough. A few percentage points of outflow from metro cores can reprice land, reshape tax bases, and bend local economies.

The Human Dividend

Katherine Boyle, a writer and investor at a16z, has argued that Starlink could save the American mother, allowing families to escape expensive metros, reclaim larger homes, and reconstitute multigenerational households where grandparents can help raise children. Her point is not about hedonic pricing or distance gradients, but about family infrastructure. Broadband, in this telling, is what makes kin viable again.

We agree with the thrust. Broadband alone won’t reverse America’s fertility crisis on its own, but it removes one hard constraint. Parents can square remote work with child-rearing. Grandparents can rejoin family life. Space becomes affordable without severing economic ties.

But this is a double-edged sword, and the dividend can cut both ways. Connectivity can collapse distance but it cannot conjure community. If dispersion accelerates without civic fabric, what we gain in square footage we may lose in friendship, family formation, and collective purpose. Without peers or third places, young singles risk swapping rent savings for isolation, in a nation already suffering a loneliness epidemic.

That’s the paradox: a technology that makes it possible to live anywhere may, if misused, leave people stranded everywhere.

Where do we go from here?

The last comparable realignment came with the highways of the 1950s, which enabled suburban dispersion. The digital divide that has reinforced the urban premium for decades is cracking along a thousand fault lines. Timber country, desert valleys, coastal islands, and once-forgotten places across the checkerboard are stirring back to life. Distance is becoming a choice rather than a sentence.

The calculus has changed. You no longer need to trade career relevance for space and affordability. You don’t have to accept isolation as the price of independence. Policymakers finally have a tool to reverse the hollowing out of rural America. Not through subsidies or nostalgic appeals, but through the restoration of economic viability. Investors face a temporary arbitrage window that’s noisy and uneven, but potentially rich in asymmetric returns for those who can recognize the mispricing first.

Seven moves for seven players:

Policymakers: Subsidize results, not ideology. The federal government would be well-served by embracing technology-neutral broadband subsidies. Long biased toward fiber builds, talk of major rural broadband programs shifting toward platform agnosticism would reflect sound economics: let satellites compete with fiber where each performs best. In dense settlements, fiber will rule. In the open countryside, LEO will likely be the faster and cheaper bridge. Rural constituencies shouldn’t be held hostage to ideological preferences for ground-based infrastructure. The goal is ubiquitous access, not orthodoxy.

Investors and developers: Hunt in the strike zone.

Our modeling points to 30-100 km belts around major metros as the sweet spot: far enough to benefit from softened distance penalties, close enough to retain city ties. Add water rights, utilities, natural amenities, and civic infrastructure, and you have migration flywheel conditions. Beyond the sweet spots, seek areas (e.g., irrigated farmland with water rights, mountain communities with natural amenities, coastal areas with development potential) previously discounted solely due to digital infrastructure gaps. If broadband was the only missing piece, these locations may be significantly undervalued. Early movers will likely capture the arbitrage before it gets priced in.

Satellite operators: Don’t take your spectrum for granted.

Throughput matters, but spectrum access is existential. There’s already an invisible but fierce battle raging for RF spectrum, which is finite and congested. LEO constellations require vast frequency bands, creating direct conflict with incumbents, including GEO operators, terrestrial 5G networks, weather forecasters, national security users, radio astronomy. Recent FCC changes favor new LEO entrants, but intense competition for this essential, invisible infrastructure continues.

Rural leaders: Pair broadband with social infrastructure.

A dish can light up a farm but it cannot deliver a pediatrician to a clinic or a teacher to a classroom. The communities that will capture the migration dividend are those that treat connectivity as foundation, not finish line, and pair connectivity with civic capacity. This will reflect in schools that can handle enrollment spikes, healthcare systems that can serve young families and aging populations, and infrastructure built for growth rather than decline.

Young adults: Weigh space against isolation.

Rural broadband makes geographic arbitrage tempting: lower rent, bigger rooms, faster internet than some suburbs. But space without community is isolation, and this is not a winning trade. America’s loneliness epidemic hits the digitally native generation hardest. Connectivity removes one constraint; it doesn’t supply friends, mentors, or serendipitous encounters that spark careers and relationships. Before decamping to the countryside, ask whether you’re building a life or just buying cheaper solitude.

Families: Rediscover the multigenerational dividend.

Ubiquitous broadband breaks the geographic constraint that has forced families into impossible trade-offs between career access and affordability. For the first time in generations, some knowledge workers can maintain urban-level economic participation while living in homes large enough for extended family. This allows the grandmother to move in, help with childcare, and provide more reliable, culturally aligned support than any childcare subsidy or professional service. Broadband doesn’t just enable remote work; it can restore one of the most durable forms of social infrastructure America has ever had.

Market participants: Look inland, not just outward.

The greatest arbitrage opportunities may lie not in the familiar exurban rings around expensive coastal metros, but in the overlooked and long-discounted American interior. Places written off for decades due to digital isolation suddenly can suddenly compete on their fundamentals: abundant water rights, cheap energy, natural amenities, proximity to agricultural and logistics networks. Once connectivity is normalized, these locations compete (and trade) on intrinsic value rather than infrastructure deficits. The question is whether investors can see past coastal bias to recognize value where it actually resides.

Where this goes is not preordained. We could waste this moment, letting rural connectivity become another subsidy sink, or watch as technology meant to collapse distance deepens isolation, scattering people into cheaper square footage without the social fabric that makes life livable. Alternatively, we could get a new supercycle of American dispersion and growth — a redistribution of opportunity as significant as Eisenhower’s Interstate Highway. Either way, the map is shifting. The notion that proximity determines prosperity is wobbling for the first time since the frontier officially closed in 1890. But this frontier requires no conquest or displacement. It demands only recognition that space and relevance can coexist, and that geography can serve rather than constrain ambition.

The frontier is reopening. The choice of how to settle it belongs to us.