Introduction

How America really feels about reindustrialization

Talk of “Made-in-America” is everywhere. Yet when we went hunting for hard data on how Americans at large feel about reindustrialization, we came up empty.

So, we teamed up with the very people who coined and popularized “reindustrialization” — the good folks at NAIA, the New American Industrial Alliance. Together, we commissioned and conducted our own survey of the American public with The Harris Poll, fielded in two nationally representative waves.

The result: responses from 2,138 U.S. adults and 5,800+ percentage cells on automation, skills, competitiveness, and public understanding of the industrial, economic, and technological forces shaping our future.

What we found isn’t a tidy narrative. The numbers offer a tidal wave of encouraging signals, alongside a set of tensions: broad support, low familiarity, cautious momentum. A country that wants to build — but isn’t always sure how. This isn’t about prediction. It’s about orientation. Where things are shifting, where they’re stuck, and what it means for anyone trying to move them forward.

This is Per Aspera’s first-ever Pulse Check on the nation.

A note on methodology

Our survey was designed to cover four key industrial buckets: A) automation & productivity, B) talent & skills, C) global competitiveness & strategy, D) education & public understanding (or lack thereof). We ran the survey across two waves (Q4 2024, and last month) with a group of ~1,050 nationally representative U.S. adults. We asked the same survey questions, providing us with a baseline, deltas, and a 180-day X-ray of America’s industrial psyche.

Section 001

America’s industrial mood, quantified

The numbers show us a snapshot of a nation working to reconcile its industrial heritage with its technological future.

We see a public whose views are crystallizing: attitudes are hardening around the need to build at home, softening towards the technology that will help do it, and converging into a broad public mandate to reindustrialize (and reskill).

The optimism is tangible, but it comes bundled with confusion, uncertainty, and a clear ask: assurance that the gains of this technology-driven industrial comeback will lift paychecks and prospects across ZIP codes, not just for elites in coastal tech hubs.

We opened the poll looking for immovable facts, and three super-majorities answered right away.

001 / A Made-in-America Mandate. The economic importance of manufacturing in the United States is a point of near-universal agreement in the public. Nearly nine in ten adults agree with this sentiment — 88% in total, with a remarkable 64% of respondents in Wave 2 “strongly agreeing.” In modern polling, numbers that large are as close to unanimity as you get. Almost no cohort breaks ranks on this point.

002 / Bring Back Shop Class, Scale Vocational Training: The same public that cheers on new factories believes that trade & vocational training must return to the mainstream. 86% agree (53% strongly) that “promoting manufacturing and skilled-trade careers would benefit students’ education.” Nearly the same share (85% net-agree, 50% strongly) want educational institutions to do more to promote manufacturing jobs, skilled-trade pathways, apprenticeships, and shop class. This is revealing! It turns a decades-old cultural shrug into a politically popular lay-up.

003 / We Know What We Don’t Know. A lone negative super-majority rounds out the picture: 81% agree that most Americans are unfamiliar with high-tech manufacturing. Self-assessment echoes that verdict: three-quarters feel confident describing traditional factories, yet only one-quarter claim deep knowledge, and confidence drops a full ten points when the question shifts to advanced factories, chip fabs, and robot lines. Hearts are in, but heads are hazy.

Section 002

The automation question

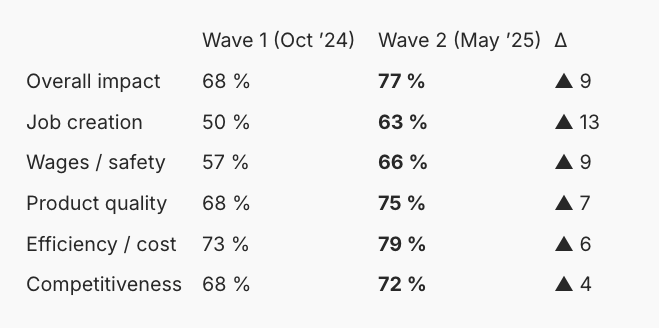

Six months made a visible dent: every metric climbed, some by double digits — the sharpest gains anywhere in the survey.

What exactly did we measure? Six separate perceptions of factory automation: 1) overall economic impact, 2) job creation, 3) wages & worker safety, 4) product quality, 5) production cost/efficiency, and 6) U.S. competitiveness on the global stage.

As of last month, roughly eight in ten U.S. adults think increasing automation in domestic manufacturing will have an at least somewhat positive impact on the industry overall:

What moved the most? Belief that robots create — rather than cut — jobs jumped 13 points, flipping a bare majority into a solid one. Confidence in wage and safety benefits rose almost as much, suggesting workers aren’t just tolerating automation—they increasingly see personal upside.

Automation draws broad praise, but the contours of that praise vary sharply by who you ask. Who’s sold, and who’s skeptical?

Enthusiasm climbs with education & income: College grads are ~15 points more likely than high-school graduates to call automation very positive, and they’re also ahead on every benefit (jobs, wages, competitiveness). Add income and the pattern intensifies: $100K+ households show the same high optimism, yet their uncertainty rate is barely half that of families earning <$50K. In short, credentials and cash reduce doubt.

Age bends the curve differently. Support rises with birth year — and so does doubt. Gen Z posts net-positive scores (74%) that rival Boomers (79%), yet younger adults still answer Not sure (11%) at 2× the rate of their grandparents’ generation (Boomers being just 5% unsure). This is proof that belief in the upside coexists with limited firsthand exposure. Another theory: Boomers, who lived through decades off-shoring, now see automation as a fix. Twenty-somethings see potential but want receipts.

Thread these strands together and a single arc appears: the better resourced and better credentialed are already sold, while the young and the lower-income are persuadable if they see real pathways — job transition, retraining, up-skilling, and the creation of new types of jobs that automation enables.

Public consensus says automation is indispensable for U.S. industrial strength; the mandate is to prove it won’t leave people behind.

Section 003

Competition with China

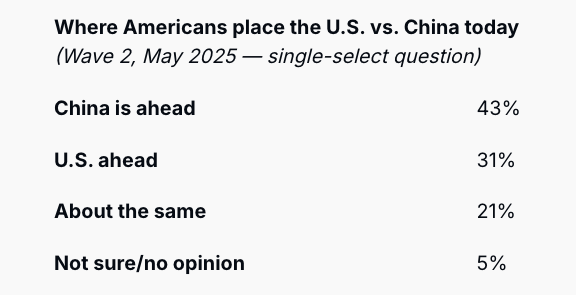

Public expectations are front-loaded: a plurality of Americans still think we trail China today (43% behind, 31% ahead), but by 2035, expect the U.S. to be ahead by 14 points.

In 2035, the same survey flipped those numbers: 40% say the U.S. will lead, 26% still see China in front, and the remainder hedge. That 14-point swing sets up high expectations and a ten-year clock.

Takeaway: Americans are an optimistic bunch. Confidence is climbing, but it rests on shaky ground. We call this “resurgent realism,” and see it as a critical psychological asset for reindustrialization efforts. The public now assumes America will close the gap. On the margins, visible wins — fabs online, apprenticeships filled, etc. — must arrive early and often to keep confidence at its current levels.

Our read is a bit more sober: the U.S. trails China on output and we’re not pacing in the right direction. We won’t intercept, let alone overtake, Beijing in advanced manufacturing, absent a muscular blend of industrial policy and private-sector firepower continuously being brought to bear over the next decade.

Section 004

Where opinions split the widest

American manufacturing isn’t a single story; it’s three overlapping fault-lines that shape who cheers, who hesitates, and why.

001 / Education: Support for automation, reshoring, and new factories rises with credentials. College graduates are about fifteen points likelier than high-school grads to label automation very positive and lead on every benefit, from job creation to global competitiveness.

002 / Income: Optimism tracks paychecks. Households earning ≥$100K post the same top-line enthusiasm but only half the Not sure rate of families <$50K. High earners see robots as productivity partners; lower-income adults seem to want proof of personal/professional robot gains before they sign on fully.

003 / Generation: Think of Boomer v. Zoomer as Hope v. History. The biggest spread in the crosstabs is generational. A plurality of Gen Z and Millennials (43%) say the U.S. leads China in advanced manufacturing today, while only 19% of Boomers share this view — a 24-point (!) optimism gap.

Boomers’ confidence and caution likely reflect their lived experience. They understand the realities of today’s world more clearly: a commanding 93% of Boomers in Wave 1 agreed that manufacturing jobs today demand more technical skills than in the past. But they are more measured in their assessment of American industrial competitiveness on the global stage. Older cohorts carry the memory of decades of off-shoring and millions of manufacturing jobs lost.

Younger generations, meanwhile, have grown up amid SpaceX headlines and as ChatGPT daily active users. They carry less of the realism and lived experience of Boomers and may see advanced technology as the equalizer on the global stage (even if it does not provide direct personal or professional uplift).

Surprise alignments & cognitive dissonance

- Elites want shop class. Paradoxically, the most automation-optimistic slice of the survey — high-earning, college-educated adults — is also the loudest champion of modern shop class. This group backs K-12 trade programs by a 15-point margin, turning credentialed elites into unlikely patrons of vocational revival.

- Meet the New Industrial Optimists: Young, diverse, and often well-educated, this cohort posts the highest optimism scores on a U.S. manufacturing comeback, breaking the stereotype that pro-manufacturing zeal lives only in legacy factory towns.

- Squaring the circle: The digital-native generation defaults to tech-as-opportunity narratives. They reconcile seeming contradictions by toggling lenses: at the macro level, tech-driven factories look like ladders wrapped in silicon and steel — tools for national progress and upward mobility; at the micro level, many still say Not sure, indicating a real knowledge gap. Many don’t even know where to look for these careers; they need to be pointed toward the openings, the on-ramps, and the wage ladders first. Show them paid apprenticeships, clear progression paths, and a firsthand view of today’s high-tech shop floors, and curiosity will harden into conviction.

- A false dichotomy: Labeling factory jobs “blue-collar” no longer matches the work on the floor. Yes, 69% still associate factory jobs with this label, yet in the same breath, an even larger share — 85% — say that these same jobs now require skills like coding, data analysis, and robotic control. The old collar-color-code assumes hands and minds operate in different worlds, but today they share the same workstation. Holding on to that binary not only misinforms job-seekers, it narrows the talent pool and skews institutions towards outdated training models.

Turning splits into strength

Who cheers for what — and how loudly they do so — tracks tightly with schooling, paycheck size, and birth year. That variance is more than polling footnote; it’s foundational for effective coalition-building. Reindustrialization succeeds only as a national, big-tent project, so the playbook must be tailored. Tune the messaging and tweak the strategy to address each cohort’s lived experience, hopes, and latent anxieties — no one-size-fits-all slogans, but targeted tactics that keeps everyone rowing in the same direction.

Section 005

Where do we go from here?

This survey leaves little doubt: America is poised, but not yet fully prepared, for a new Industrial Renaissance. Next, we translate our findings into six clear imperatives.

001: Seizing on the Made in America Mandate: The near-unanimous support for domestic production affords leaders rare political oxygen for bold moves, but credibility hangs on tangible, local results. Our read of the palpable, popular mandate for America’s industrial renaissance: it’s not just abstract patriotism, but a recognition that making important things domestically is tied to economic resilience and geopolitical moves. This provides a tailwind for industrial policy initiatives and reshoring moves.

→ Corporate leaders, founders, capital allocators, politicians, and regulators should seize on this rare consensus to underwrite ambitious projects, fast-track permits, break ground, invest boldly, craft shrewd industrial policy and generally move faster.

002: An Uneasy Techno-Pragmatism Emerges: Automation narratives appear to be undergoing a paradigm shift. In six short months, we’ve noticed an across-the-board warming to robots as necessary tools for competitiveness — with the important, but not guaranteed, proviso that they bring workers along. 77% now view automation positively in the aggregate, and majorities expect improvements in jobs and wages, indicating a new form of techno-pragmatism (even if it’s uneven and uncertain).

→ In essence, the social contract around automation is potentially being written as follows: productivity boosts are great, but shared gains are the price of admission. Companies and policymakers would be well-served to heed this social contract as they deploy automation and associated technologies on greater and quicker scales.

003: We’re resurgent realists on the global stage: The public concedes that the U.S. is “behind” in advanced manufacturing, but sentiment is shifting toward the view that America can reclaim the leading edge over China by 2035. This reflects a nascent, if fragile, optimism in U.S. industrial strategy and may be partially in response to recent U.S. measures to level the playing field. The convergence of public will and policy aim here is a powerful force. However, this optimism comes with pressure.

→ The clock is ticking and Americans are optimistic we can rise to the occasion. If the U.S. doesn’t meet the public’s expectations — which is far from a given — disappointment could be sharp. (And there are plenty of other consequences, beyond “public disappointment,” that one could also rattle off…)

004: Manufacturing translators and storytellers wanted: Support for the new industrial era is already sky-high — including domestic manufacturing, high-tech production, and modern vocational training. Yet a stubborn fact remains: more than eight in ten Americans think the public has no clue what’s going on inside a high-tech factory. This has the markings of a knowledge gap. Hearts are in, heads are hazy. Popular misconceptions of modern manufacturing abound: recall the false dichotomy of what a modern factory is, the collar-color-code dilemma, etc. Fixing this strategic deficit, and making this world accessible to a wider audience, means more than just serving up facts and figures.

→ We need to tell better stories that resonate with people and reflect today’s realities. The companies and organizations that best communicate this will win hearts and minds, and attract the next generation of talent.

005: Serve the shop class supermajority: There is overwhelming public consensus for integrating manufacturing and skilled trades into early education. Nearly nine in ten say K-12 should spotlight manufacturing and skilled trades; half strongly agree, a level of intensity usually reserved for grandma and apple pie. That mandate goes far beyond a sixth-period workshop: it also includes dual-credit CNC courses, paid apprenticeships, GI-Bill-style retraining, and employer-run bootcamps. Institutions that can’t meet this moment should clear the lane for those that can.

→ Four-year colleges mint degrees, not machinists; the leverage sits farther down the line. The task is explicit and nationwide; districts, community colleges, and employers that move first will meet ready demand. The public mandate is on the table — update the ladder now, or cede the rung to somebody else.

006: Close the confidence gap: Enthusiasm for automation and high-tech manufacturing clusters among those who already sit in the capital stack; high earners atop the labor market; and older generations aging out of the workforce. And while enthusiasm is rising fastest among high-school-only and <$50K households, these groups still trail college grads and six-figure earners by ~15 points on “very positive” automation sentiment. The drag isn’t (necessarily) hostility — it’s uncertainty, as we’ve unpacked. If enthusiasm or confidence grows fastest among cohorts already advantaged in the labor market, public support for technology deployment could plateau.

→ If technology’s gains, real or perceived, aren’t felt by the broader population, the confidence gap could widen, the coalition for deployment could unravel, and today’s confidence could quickly give way to fresh resistance. Closing this confidence deficit is not easy but it is also non-negotiable.

Parting Thoughts

All in all, the numbers offer a once-in-a-generation tailwind — and implicitly, a flashing green light to builders, leaders, and allocators willing to think big. Americans decisively want chips, turbines, cars, rockets, robots, and ships proudly stamped Made in the USA, but readily admit that they do not understand the technology (or pathways) that will help us secure this industrial future.

It falls on us to close these knowledge and confidence gaps, so that we can ensure that this enthusiasm maps to opportunities and outcomes. Our charge is to light the way: turn curiosity into know-how, uncertainty into skill, and nationwide enthusiasm into a world-class industrial base.

America rarely sees such unity, and it is a rare blessing — broad in its reach, clear-eyed in its demand. If we miss the moment, factories and fabs will fly under other flags, and the leverage they confer will be bargained away. If we rise to the occasion, we can bank four dividends at once: durable growth, greater national resilience, faster cycle times, and work that restores pride and local communities across the country.